Why Value Capture is the Most Important Business Idea You Haven’t Read Enough About

Note: Republishing this post I shared on the Medium paid subscription a few years ago. This was originally written in September 2015.

Great businesses don’t have to be big — and big businesses can be awful. The measure of the quality of a business is all about Value Creation and Value Capture.

Value Capture (a business’s ability to create profit from its transactions) is one of the most interesting and under-studied areas of business. In my reading and research, I’ve seen material on it, though rarely with the same terminology.

It’s a concept explored by people like Warren Buffett, Charlie Munger, Peter Thiel, Bill Gurley, and many academics, though knowledge doesn’t build and compound because everyone talks about it just a little differently.

This is a topic that I’ve been fascinated with for a while, making it really fun to put this collection together. Any topic that has overlapping opinions from Charlie Munger and Peter Thiel is something to get excited about.

In this Collection of Evergreen, we’ll explore:

The Relationship Between Value Creation & Value Capture

How Required Reinvestment Destroys Value Capture

Why Not All Revenue is Created Equal

How Pricing is the True Test of Value Capture

How to Capture More Value

How Measure Value Capture, and its Inevitable Decline

Enemies of Value Capture: The Red Queen Effect

Independence of Value Creation & Value Capture

This is one of Peter Thiel’s favorite topics. He calls it one of the most important and least-understood things in business. It is the first topic that he goes through in his talk at Stanford this year, and he devoted chapters to it in his book, Zero to One.

Here are some of the highlights from Thiel’s book:

What Valuable company is no one building? This question is harder than it looks, because your company could create a lot of value without becoming very valuable itself. Creating value is not enough — you also need to capture some of the value you create.

The big idea from his lecture is this:

A business creates X Dollars and captures Y% of $X.

X and Y are Independent Variables.

X and Y have nothing to do with each other. They are not interrelated at all. Just because a business is large, does not mean that it is making a huge amount of money. Conversely, very high-quality small companies can capture huge percentages of their revenue.

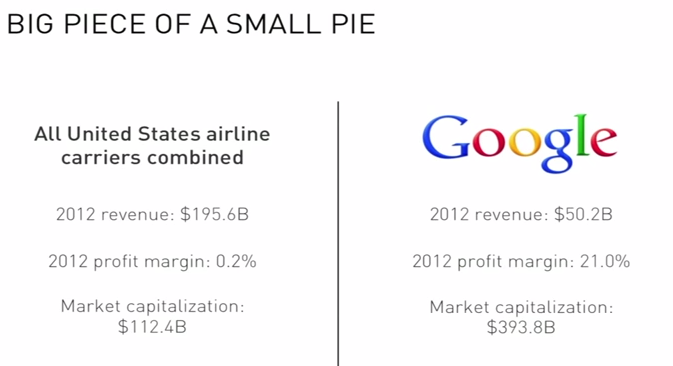

That means that even very big businesses can be bad businesses. For example, US airline companies service millions of passengers and create hundreds of billions of dollars of value each year. But in 2012, when the average airfare each way was $178, the airlines only made $0.37 per passenger trip. Compare them to Google, which creates less value but captures far more. Google brought in $50 billion in 2012 (vs $195 billion for the airlines), but it kept 21% of those revenues as profits — nearly 100x the airline industry’s profit margin that year. Google makes so much money that it is worth 5x more than all US Airlines combined.

By these numbers, Google is 100x more effective at capturing value than the airlines. We’ll get into this more later, but margin is a good basic proxy for ability to capture value. Google has this power because it owns its market — Google has a monopoly on search.

Whereas a competitive firm must sell at a market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes profits. […] by ‘monopoly’ we mean the kind of company that’s so good at what it does that no other firm can offer a close substitute.

So, from Peter Thiel, the first rule of value capture:

The lesson for entrepreneurs is clear: if you want to create and capture lasting value, don’t build an undifferentiated commodity business.

Buffett & Munger on Value Capture and Reinvestment

Warren Buffett learned this lesson himself early on, after buying Berkshire Hathaway, which was then a slowly dying textile manufacturing business. Charlie Munger tells that story here, and shows how tough it is to capture value in commodity businesses.

Yes, this is a long excerpt. But it’s Munger and it’s a fantastic lesson.

For example, when we were in the textile business, which is a terrible commodity business, we were making low-end textiles — which are a real commodity product. And one day, the people came to Warren and said, “They’ve invented a new loom that we think will do twice as much work as our old ones.”

And Warren said, “Gee, I hope this doesn’t work because if it does, I’m going to close the mill.” And he meant it.

What was he thinking? He was thinking, “It’s a lousy business. We’re earning substandard returns and keeping it open just to be nice to the elderly workers. But we’re not going to put huge amounts of new capital into a lousy business.”

And he knew that the huge productivity increases that would come from a better machine introduced into the production of a commodity product would all go to the benefit of the buyers of the textiles. Nothing was going to stick to our ribs as owners.

That’s such an obvious concept — that there are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.

Conversely, if you own the only newspaper in Oshkosh and they were to invent more efficient ways of composing the whole newspaper, then when you got rid of the old technology and got new fancy computers and so forth, all of the savings would come right through to the bottom line.

In all cases, the people who sell the machinery — and, by and large, even the internal bureaucrats urging you to buy the equipment — show you projections with the amount you’ll save at current prices with the new technology. However, they don’t do the second step of the analysis which is to determine how much is going stay home and how much is just going to flow through to the customer. I’ve never seen a single projection incorporating that second step in my life. And I see them all the time. Rather, they always read: “This capital outlay will save you so much money that it will pay for itself in three years.”

So you keep buying things that will pay for themselves in three years. And after 20 years of doing it, somehow you’ve earned a return of only about 4% per annum. That’s the textile business.

And it isn’t that the machines weren’t better. It’s just that the savings didn’t go to you. The cost reductions came through all right. But the benefit of the cost reductions didn’t go to the guy who bought the equipment. It’s such a simple idea. It’s so basic. And yet it’s so often forgotten.

The hard choice that Buffett had in this situation was to continue to invest where he knew he wouldn’t get return, or to shut the business down. If he didn’t buy the new machines, competitors would, and he’d be out of business anyway.

This is the nature of competition in capitalism. As Peter Thiel said, you want to deliver something so clearly unique and special that no other business can keep up, or you will end up in this same place as Buffett — pouring money into a business that will never return your investment because you cannot capture value.

Not All Revenue is Created Equal

A business’s ability to capture value is a main input into it’s valuation (remember how Google was valued at 4x all airlines put together?) Ability to capture value is crucial to command a strong valuation and build a valuable business.

The way investor Bill Gurley thinks about this is Revenue Quality. It’s a new way of thinking about value capture. He wrote a great post called All Revenue is Not Created Equal, where he lists the factors of ‘good revenue’ which will lead to a good valuation and a valuable business. They are also indicators of ability to capture value.

One dynamic that is especially relevant to value capture is switching costs. If customers have reasonable substitutes to your product and it’s easy for them to make that change, it’s going to be much harder to retain all of your customers over the long term, which weakens your ability to capture value.

Retaining customers for long periods of time is obviously a positive. Conversely, if customers are churning away from your company, this is a huge negative.

With subscription models, a low-churn customer is quite valuable. In fact, companies with excessively low churn rates (5% annually or less) are very likely to have price/revenue multiples in the top decile. Obviously, high churn rates are really bad for all valuation multiples.

For non-subscription businesses, customer-switching costs also play an important role. If it is relatively easy for your customer to switch back and forth from your products to you competitors, you will likely have a lower price/revenue multiple as your pricing power will be quite limited. On the other hand, if it is quite difficult for a customer to switch away from your product/service, you are likely to have stronger pricing power, and longer customer life, which will inevitably result in better DCF dynamics.

Switching costs can take many forms — technical lock-in, data lock-in, high startup costs with a new vendor, and downstream revenue dependencies are just a few. All things being equal, high switching costs are a positive for price/revenue multiples, and low switching costs are a negative.

Though Gurley does not specifically mention value capture, that is the core of what he’s writing about. He jumps from the Revenue Quality directly to valuation — the connection between those is the concept of value capture.

Gurley’s post is a great read, blending financial and theoretical concepts into a new perspective on value capture.

Pricing — The Test of Value Capture

A business’s ability to capture value is most easily tested with one simple challenge: Can you raise prices without losing customers?

My favorite thing that I found in doing this research is this quote from Warren Buffett.

The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price 10 percent, then you’ve got a terrible business.

There are a lot of lessons in these few sentences. He shows that a good business must have the ability to capture value. And, that the test of value capture is pricing power. If you’re deathly afraid to raise prices, you do not have what Thiel would refer to as a ‘monopoly’ — you don’t control your market.

This is a test that Warren Buffett has understood for a long time. In this excerpt from Tren Griffin’s new book on Munger, Charlie talks about some of the investments that he and Buffett have made that passed this test:

There are actually businesses that you will find a few times in a lifetime, where any manager could raise the return enormously just by raising prices — and yet they haven’t done it. So they have huge untapped pricing power that they’re not using. That is the ultimate no-brainer…

Disney found that it could raise those prices a lot and the attendance stated right up. So a lot of the great record of Eisner and Wells… came from just raising prices at Disneyland and Disneyworld and through video cassette sales of classic animated movies…

At Berkshire, Warren and I raise the prices of See’s candy a little faster than others might have. And, of course, we invested in Coca-Cola — which had some untapped pricing power.

The thought exercise of the plausibility of raising prices in your business is an interesting one. It’s a good way to force you to consider the strength of your competitive advantage, the barriers to entry of your industry, the quality of your revenue — all determinants of your ability to capture value.

[Explore Pricing optimization in the Evergreen collection on Pricing.]

How to Capture More Value

Abdy Mohamed contributed an excellent article from the Harvard Business Review by Professor Stefan Michel called Capture More Value.

First, he explains why so many companies usually under-invest in optimizing value capture, and how much is lost due to this oversight.

Both kinds of innovation — one in value creation, the other in value capture — are important. But most companies focus only on the first. Sometimes a business can get away with failing to think about value capture if it sells plenty of its new offerings through existing approaches. But when value capture goes unexamined, money is usually left on the table — and sometimes the only thing that can save a business is finding a way to capture value.

Yet even avid innovators often have a blind spot when it comes to value capture. They may assume that if value is created, rewards will follow. Indeed, one reason value-capture innovation tends to be overlooked is that companies that do it well often simultaneously innovate in value creation, and the latter tends to take center stage.

In the article, he reveals a framework that he developed showing 15 different ways to capture more value from a business’s current engine of value creation. It’s helpful to take a look at the variety of tactics available.

Nespresso is a great example of one of the tactics. The margin increase of their coffee sales through re-packaging the beans is wild:

Consider Nespresso, which manufactures single-cup coffee makers and the capsules used in brewing. Yes, the launch of such a handy appliance is an exercise in value creation. But any innovation that allows a company to sell $19 worth of a commodity (the typical retail price for a kilo of coffee beans) for up to $137 must also be celebrated for its value capture.

The bottom line from Professor Stefan Michel? There’s easy work to do, and a lot more benefit to be gained from some focused work on value capture.

My work with more than 50 companies in dozens of countries has confirmed for me that businesses have spent far more time, money, and effort on value-creating innovations than on value-capturing ones — and that much can be gained by correcting the imbalance.

Value creation is much harder to add as an augmentation rather than a first principle of creating a business or product — many of the determinants (competition, industry structure) are unchangeable, and these tactics can only optimize for the environment you’re already in.

Measuring the Moat & Fade Rate

There are two big papers that I came across independently in the rabbit hole of research, which both happened to be by Michael Mauboussin.

Measuring The Moat is about “Assessing the Magnitude and Sustainability of Value Creation” — a fascinating read. It is about 50 pages, and dense with content in the best way possible, it moves quickly and covers a lot of topics which all create an understanding of how value is created and captured.

One of the most interesting to me was to see the comparison of turnover vs. margin. Some businesses capture value through massive scale and small margin, while others have created huge margin (consumer advantage) and can create return with much lower asset turnover.

The most surprising thing that I learned from Measuring The Moat was about Brands. I often enter these research binges with a set of written hypotheses, and my hypothesis that Brand was an enabler of value capture was demolished by this paper:

Interbrand, a brand consultant, publishes annually its list of the most valuable brands in the world. If brands are clearly linked to value creation, you should see a one-to-one relationship between brand strength and economic returns.

This is not the case empirically. Of the companies that own the top ten most valuable brands, two did not earn their cost of capital in the latest fiscal year, and there is no clear pattern between brand ranking and economic return.

So a brand is clearly not sufficient to ensure that a company earns economic profits, much less sustainable economic profits.

Measuring The Moat is something I’m very glad to have read, and already look forward to re-reading regularly. It has a powerful set of ideas for evaluating the ability of a business to create value and capture it, by studying their industry and competitive advantages. Learning the methods of analysis in this paper (profit pools were a new one to me) have already changed how I think about assessing companies in their industry context.

The second (much shorter) paper called Competitive Advantage Period explores the death of value capture. When and why competitive advantage fades away, and how to define and think about that eventuality (and it is an eventuality.)

Competitive Advantage Period (CAP) also known as Fade Rate, is a concept used by investors to understand how long an advantage will be relevant, and what kind of value the company will be able to extract during it’s decline.

A slow erosion due to competition has very different implications for a business than a sudden obsolescence due to a technological innovation.

Both of these papers require a little patience, and tolerance for investor-targeted writing, but they contain excellent information and ideas you won’t see elsewhere on value creation and value capture.

Red Queen Effect — An Unwinnable Race

There is no such thing as winning in business, there is only surviving. No Competitive Advantage is invincible or permanent. Thanks to Brent Beshore for teaching me about the Red Queen Effect as it applies to Business.

Competitive Advantage is rare and short-lived in the biological world as well. Indeed, it is exactly what one would expect in an evolutionary system. In biological systems, species are locked in a never-ending coevolutionary arms race with each other. As we noted earlier, a predator species might evolve faster running speed, its prey might evolve better camouflage, while the predator might then evolve a better sense of smell, and so on, indefinitely, with no rest for evolutionary weary.

Biologists refer to such coevolutionary spirals as Red Queen Races, named after the Red Queen in Lewis Carroll’s Through the Looking Glass. It was she who said, “In this place it takes all the running you can do, to keep in the same place.”

There is no such thing as winning a red queen race; the best you can ever do is run faster than the competition.

All we can do is to create and capture the most value possible while we maintain a Competitive Advantage. Value capture is important to ongoing survival because it allows for reinvestment in the business to create a stronger competitive advantage or fund R&D for new products. Living on thin margins does not allow for any lapse in quality of execution, and certainly doesn’t enable a business to reinvest.

Vincent Huang shared this great post by Peter Levine that explores Red Hat, who is having some of these exact problems because their model doesn’t enable them to capture much value.

There are many reasons why the Red Hat model doesn’t work, but its key point of failure is that the business model simply does not enable adequate funding of ongoing investments. The consequence of the model is minimal product differentiation resulting in limited pricing power and corresponding lack of revenue. As shown below, the open source support model generates a fraction of the revenue of other licensing models. For that reason it’s nearly impossible to properly invest in product development, support, or sales the way that companies like Microsoft or Oracle or Amazon can.

If you’re running a business with low value capture, you’ll end up fighting someone with a much bigger war chest and more room to maneuver.

Value Capture has many Enemies: Reinvestment, Red Queen, Technological Obsolescence, Commoditization, Competition, and plain old poor execution. We can’t outrun all of them forever, all we can do is run hard and try to beat a few of the competitors.