Why Value Creation is the Foundation of Business: How to define it, measure it, and manage it

Note: Republishing this post I shared on the Medium paid subscription a few years ago. This was originally written in September 2015.

Value Creation

Business begins with value creation. It is the purpose of the institution: to create and deliver value in an efficient enough way that it will generate profit after cost.

Because value creation is the starting point for all businesses, successful or not, it’s a fundamental concept to understand. Here’s what is to come in this collection of wisdom about value creation:

Definition of Value, and how it can be created

Evolution of value creation through history, and in the future

How value can be measured and managed

In the next Edition, we’ll pair this with research on Value Capture — join Evergreen to be sure you get the follow-up to this post.

How Value is Created (Value Defined)

In the broadest terms possible, value is created through work. This work could be mechanical (cutting a tree down and turning it into lumber) or creative (creating a logo or writing a paper). Of course, not all work is value-creating (Sisyphean tasks like moving rocks from one place to another, then back).

The purpose of a business is to create value (through work), sell or trade it to customers, and capture some of that value as profit. (Ok, Duh, yes, but we’re starting from the bottom here).

A Precise Definition of Value Creation

In his excellent book, The Origin of Wealth (graciously gifted to me by Nathan Bashaw), Eric Beinhocker offers a scientifically rigorous definition of the creation of economic value, based upon the work of the Economist Georgescu-Roegen:

A pattern of matter, energy, and/or information has economic value if the following three conditions are jointly met:

1) Irreversibility: All value-creating economic transformations and transactions are thermodynamically irreversible.

2) Entropy: All value-creating economic transformations and transactions reduce entropy locally within the economic system, while increasing entropy globally.

3) Fitness: All value-creating economic transformations and transactions produce artifacts and/or actions that are fit for human purposes.

For those who didn’t take a Thermodynamics course in college (myself included), substitute entropy for ‘disorder’ for a decent approximation. So in more normal-human words: Value is created through an irreversible process which gives a resource’s ‘order’ greater usefulness to other humans.

Under this definition, almost any activity can be value-producing, from opening a door for someone, to writing something, to turning the sun’s energy into power to run your ceiling fan.

Not All Value is Created Equal

As there are an enormous (and ever-increasing) set of possible ways to create value, how do we decide which type to pursue? Is each way of creating value as useful to us as another?

Peter Thiel doesn’t think so. In his incredibly useful book, Zero to One, he talks about the conditions of a successful business. All businesses must create value, but some types of value (and methods of value creation) are more useful than others. His book is summarized in this talk at Stanford:

Creating value by producing a commoditized product is not a pathway to success. Think about the substitutability of your product or service: Do customers have a wide array of other options? Do they have to make a purchase at all? Are you meaningfully distinct from your competitors?

If your industry is in competitive equilibrium, the death of your business wouldn’t matter to the world: some other undifferentiated competitor will always be ready to take your place.

This is the condition for most businesses — what they sell is not unique, but generally substitutable. If you want to create the kind of value that builds a lasting and successful business, Thiel says you must be unique:

All happy companies are different: each one earns a monopoly by solving a unique problem.

To solve that unique problem, you must develop unique skills or processes:

In the real world outside of economic theory, every business is successful exactly to the extent that it does something others cannot.

This set of ideas is really to lead-in to studying Competitive Advantage, the ‘how’ of developing and delivering on this unique value proposition. What does your business do that others can’t match?

Thanks to Victor Sowers and Itamar Goldminz for recommending this set of Peter Thiel’s ideas!

Note: Delivering a commoditized product with a radically improved cost structure is certainly a Low-Cost Competitive Advantage, and is a very worthwhile method of value creation.

Value Creation Chain (through an Organization)

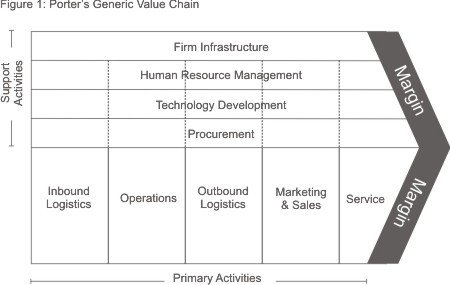

For a visual way to consider value creation, let’s take a look at Porter’s Value Chain. The Harvard Business School Professor generalizes all business processes and shows each contributes to the organizations goal to create value for customers:

These ‘Primary Activities’ are the process alluded to in our first definition from Beinhocker, which do the ‘work’ to create the value that customers are paying for:

Inbound logistics — These are all the processes related to receiving, storing, and distributing inputs internally. Your supplier relationships are a key factor in creating value here.

Operations — These are the transformation activities that change inputs into outputs that are sold to customers. Here, your operational systems create value.

Outbound logistics — These activities deliver your product or service to your customer. These are things like collection, storage, and distribution systems, and they may be internal or external to your organization.

Marketing and sales — These are the processes you use to persuade clients to purchase from you instead of your competitors. The benefits you offer, and how well you communicate them, are sources of value here.

Service — These are the activities related to maintaining the value of your product or service to your customers, once it’s been purchased.

Any business will have some version of each of these activities, even if it’s just a one-person service company. This set of primary activities are the foundation for creating value as an organization.

The Evolution of Value Creation

Historic Value Creation

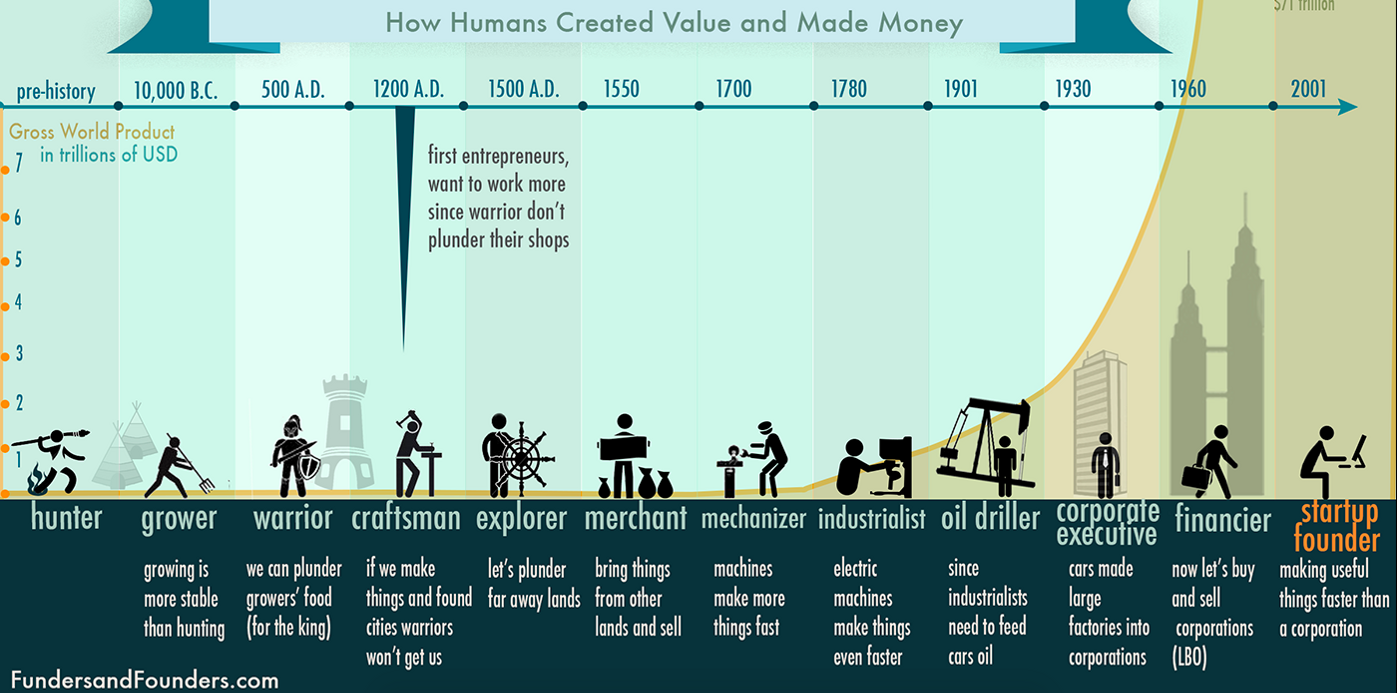

This infographic from Funders and Founders summarizes the long history of a wide variety of human attempts at value creation. I don’t consider it scientific or comprehensive (strictly speaking, I don’t think plunder count as value creation), but it is a quick way to get a sense of the evolution of the economy up until today. To see the full story, go to the site here.

Of course, there were lots of parallel types of value creation throughout history, these are just examples dominant in each era. Given where we’ve come from… where are we going next?

What Value Creation looks like in the Future

As we look at the changes in the way our economy has created value in the past 100 years, we’ve shifted from a focus on huge mechanical production during the industrial revolution to more creative and customized production through the information age. Software and related services dominate more and more of value creation.

This is a point raised by Jack Hughes in his piece in the Harvard Business Review, contributed by Victor Sowers, called What Value Creation Will Look Like in the Future:

The value of products and services today is based more and more on creativity — the innovative ways that they take advantage of new materials, technologies, and processes. Value creation in the past was a function of economies of industrial scale: mass production and the high efficiency of repeatable tasks. Value creation in the future will be based on economies of creativity: mass customization and the high value of bringing a new product or service improvement to market; the ability to find a solution to a vexing customer problem; or, the way a new product or service is sold and delivered.

[…]

We need to understand how to manage creativity as well as we do managing effort today. Productivity means we’ve wrung cost out of our operations. Creativity means we created more value: we sold X units of something that didn’t exist before; we increased the sales of Y not because we made it cheaper, but because we made it better or we increased our value to customers by servicing needs we hadn’t serviced before.

Because our economy is becoming more fluid, more individualistic, we need to open up our views on value and allow for the creative work to take its place with other more mechanical forms of value creation.

How Value Creation is Measured

So with value created in various ways — how can it be uniformly measured? Is it possible to create comparisons between value created in a variety of ways through different processes?

Value Creation as Revenue

The most simplistic way to measure value creation is through Revenue. This measure ensures that the process of value undertaken wasn’t worthless, if someone is willing to pay for it.

Revenue is the measure of value creation — not profit. A company can create value without creating a profit, and many do. But they don’t do it for long.

Peter Thiel shows this in Zero to One:

Even very big businesses can be bad businesses. For example, the US airline companies serve millions of customers and create hundreds of billions of dollars or value each year.

Compare them to Google, which creates less value, but captures far more. Google brought in $50 Billion in 2012 (versus $195 Billion Revenue for the airlines).

Revenue is not the perfect measure of value creation — only the simplest. What Revenue really measures is a floor for value creation. The total value created cannot be LESS than the revenue it generated. Here’s why…

Exchange Value vs. Perceived Use Value

An academic paper contributed by Robert Hacker was instrumental for me in understanding this concept. Written by Bowman & Ambrosini, Value Creation Versus Value Capture has explored the possible methods of measurement of value and created important distinctions.

If something is purchased, the customer perceives a consumer surplus >0, or they wouldn’t make the exchange. So the total value created is the price paid, AND the perceived value of the consumer surplus. In graphic form:

Here are the formal definitions:

Perceived Use Value is subjective, it is defined by customers, based on their perceptions of the usefulness of the product on offer. Total monetary value is the amount the customer is prepared to pay for the product.

Perceived Use Value is determined individually by each of us, and is subject to change at any time. Another measure of value is the exchange value:

Exchange Value is realized when the product is sold. It is the amount paid by the buyer to the producer for the perceived use value.

Revenue is a sufficient proxy for quickly evaluating value creation, but it isn’t a complete measure.

Further Reading on Corporate Value Measurement

If you’re interested in reading more deeply on value creation, measurement, and management in larger organizations, two books recommended by Cecile Rayssiguier are a great place to start: Value-based metrics: Foundation and Practice and Managing Customer Value.

Open Questions about Value Creation

Is it possible to create profit without creating value? Probably, but I think that counts as a scam. At best, it’s arbitrage. (Any counterpoints here?)

How do we think about value that’s created, but never monetized? Is that the creation of goodwill or karma?

What about value that is created through meaningful effort and lost before a sale? (spoilage of food, for example)